How To Choose The Best Caravan Insurance In Australia

Learn how to pick the best caravan insurance for your needs. Compare coverage, exclusions and value for money policies with Aussie insurers. Caravan insurance in Australia offers critical protection for tourers and off-road enthusiasts, with numerous providers offering varying levels of coverage to suit different needs and budgets.

This research examines the available insurance options across the Australian market, providing comparative analyses and practical strategies to help caravan owners secure optimal coverage. With comprehensive policies covering everything from accidental damage and theft to emergency accommodation and off-road recovery, understanding the nuances of different offerings is essential for making informed decisions about protecting your mobile investment.

Table Of Contents

Caravan Insurance Working Through A Checklist

Understanding Caravan Insurance In Australia

Caravan insurance in Australia is designed to protect your investment against various risks while providing peace of mind during your travels. Though not legally mandated like motor vehicle insurance, caravan insurance is considered essential for protecting what is often a significant asset[2]. The importance of proper coverage becomes evident when considering the potential financial impact of accidents, theft, or damage that can occur while touring Australia’s diverse landscapes.

Australian caravan insurance typically covers several types of recreational vehicles, including touring caravans, onsite caravans, motorhomes, campervans, and camper trailers[2]. Policies are structured to address the unique risks associated with caravan ownership and travel, providing financial protection against unexpected events that could otherwise lead to substantial out of pocket expenses.

The Australian market features numerous insurance providers, from major national insurers to specialised caravan insurance companies. Each offers distinct policy features, exclusions, and pricing structures that cater to different needs and usage patterns. Understanding these differences is crucial for securing appropriate coverage that aligns with your specific caravan type, travel habits, and risk profile.

Why Caravan Insurance Matters

Caravan insurance serves multiple essential purposes for Australian travelers. First and foremost, it protects your significant financial investment in the caravan itself. Like motor vehicles, caravans represent substantial assets that merit protection against damage or loss[2].

Beyond asset protection, caravan insurance provides critical liability coverage. Many policies include protection against damage caused to others’ property or injuries arising from accidents involving your caravan—potentially saving you from financially devastating liability claims[2]. This coverage becomes particularly important when considering the varied environments and conditions encountered during caravan travel throughout Australia.

Additionally, comprehensive policies often include coverage for contents within the caravan, emergency accommodation if your caravan becomes uninhabitable, and roadside assistance services[1][4]. These features ensure that your travels remain as uninterrupted and stress-free as possible, even when facing unexpected challenges.

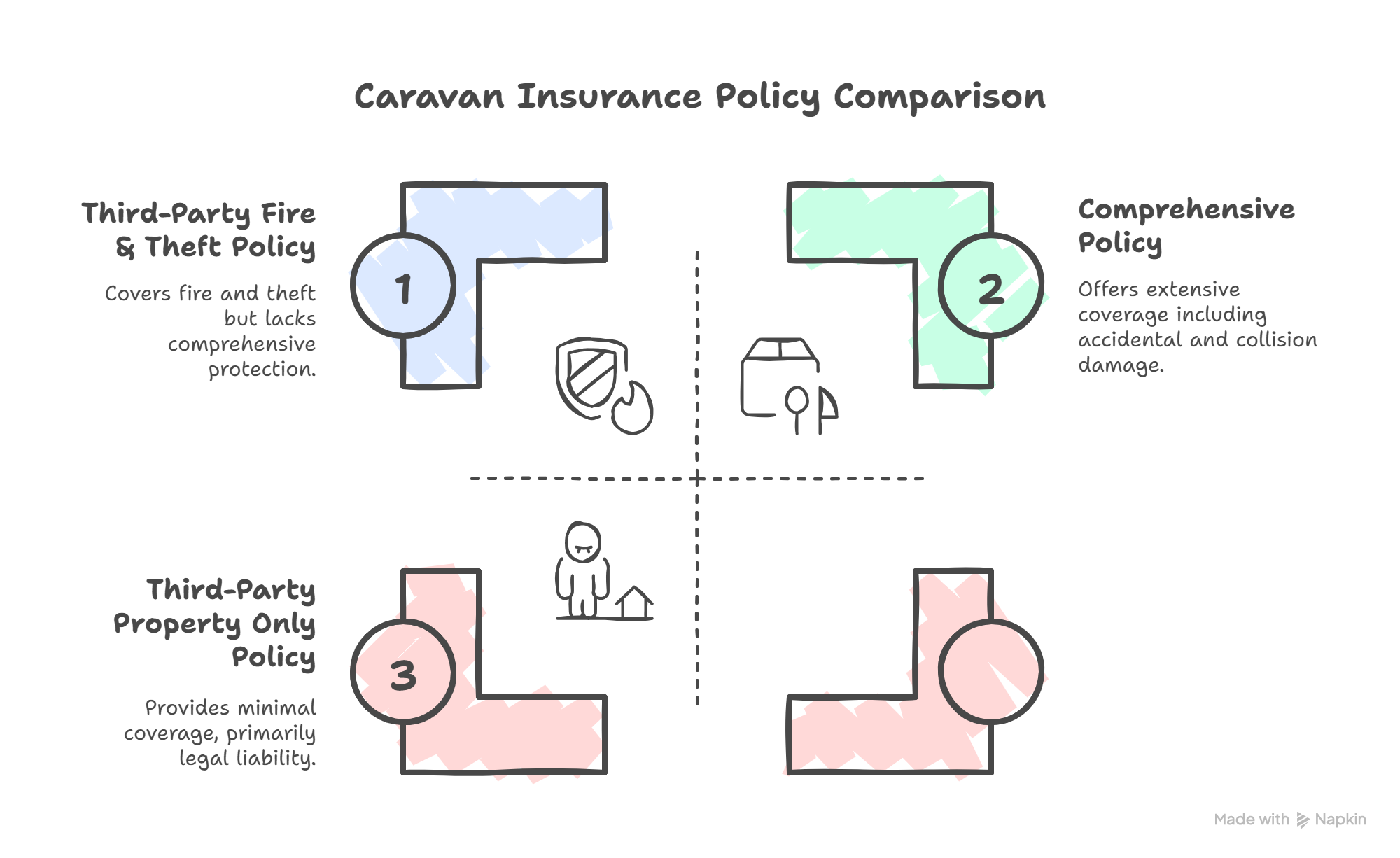

Types Of Caravan Insurance Coverage

Australian insurers typically offer several levels of caravan insurance coverage, allowing owners to select policies that align with their specific needs and budget constraints. Understanding these different coverage types is essential for making informed decisions about protecting your caravan.

Comprehensive Insurance

Comprehensive insurance represents the highest level of protection available for caravans in Australia. This coverage type protects against a broad range of risks and incidents that might occur during both travel and stationary periods[4]. Specifically, comprehensive policies typically cover:

- Accidental damage from collisions or other accidents

- Theft of the caravan or its components

- Fire damage

- Flood and storm damage

- Malicious damage or vandalism

- Liability for damage to others’ property[1][4]

Comprehensive coverage is particularly valuable for those who frequently travel with their caravan or own newer, more valuable models. The extensive protection offers peace of mind regardless of where your adventures take you throughout Australia’s diverse landscapes and weather conditions.

Third Party Fire & Theft

This intermediate level of coverage protects against damage your caravan causes to someone else’s property, along with coverage for fire damage and theft of your caravan[4]. However, it typically excludes coverage for accidental damage to your own caravan, making it a more affordable option for those willing to assume some risk.

Third Party Fire & Theft represents a middle ground between basic third-party coverage and comprehensive protection, providing essential liability protection while also safeguarding against two significant risks: fire and theft. This option may be suitable for caravanners with older models or those who keep their caravans in secure locations when not in use.

Third Party Property Only

The most basic insurance option provides coverage exclusively for damage your caravan causes to someone else’s property[4]. This minimal coverage does not protect your caravan itself against damage, theft, or other incidents, making it appropriate only for those with older caravans of limited value or those willing to self-insure against potential loss.

While the least expensive option, Third-Party Property coverage leaves caravan owners exposed to significant financial risk should their caravan be damaged, destroyed, or stolen. This coverage level is generally not recommended for newer or more valuable caravans.

Caravan Insurance Checklist

Key Features To Look For In A Caravan Insurance Policy

When evaluating caravan insurance options, several key features warrant particular attention. These elements can significantly impact the value and effectiveness of your coverage in the event of a claim.

Legal Liability Coverage

Legal liability protection is perhaps the most critical component of any caravan insurance policy. This coverage addresses your financial responsibility for damages or injuries your caravan might cause to other people or their property[4]. Many Australian policies offer liability coverage up to $20 million, providing substantial protection against potentially catastrophic claims[4].

The importance of adequate liability coverage cannot be overstated, particularly given the potential for significant financial consequences following accidents or incidents involving your caravan. Even minor accidents can result in substantial property damage or personal injury claims that could otherwise lead to financial hardship.

Contents Coverage

Contents coverage protects the valuable items you keep inside your caravan, from personal belongings and electronics to appliances and camping equipment[1][4]. Standard policies typically offer basic contents coverage starting around $1,000, with options to increase this amount for additional premium[4].

This feature is especially valuable for those who travel with expensive equipment or personal items. When assessing contents coverage, it’s important to understand any applicable sub-limits for specific categories of items (such as electronics or jewelry) and whether replacement is based on new-for-old or depreciated values.

New For Old Replacement

Some premium policies offer new-for-old replacement for caravans less than two years old that are declared a total loss[4]. This feature ensures that rather than receiving a depreciated value for your written-off caravan, you’ll receive a brand new equivalent model – potentially saving you significant out-of-pocket costs in the event of a serious accident or theft.

The availability and terms of new for old replacement vary significantly between insurers, with some extending this benefit to caravans up to five years old. This feature is particularly valuable for owners of newer caravans who want to ensure they won’t face significant financial shortfalls if replacement becomes necessary.

Emergency Accommodation And Towing

Quality caravan insurance policies typically include coverage for emergency accommodation if your caravan becomes uninhabitable due to an insured event[1][4]. This coverage ensures you won’t be stranded without shelter following an accident or damage to your caravan.

Similarly, towing coverage addresses the costs of transporting your damaged caravan to a repair facility or safe location[4]. Given the potential for significant towing expenses, particularly in remote areas this feature provides important financial protection and practical assistance when you need it most.

Comprehensive List of Caravan Insurance Providers in Australia

The Australian market offers numerous caravan insurance options from both specialised providers and general insurers. The following table provides a comprehensive listing of major caravan insurance providers operating throughout Australia, along with their contact information:

National Insurance Providers

| Insurer | Parent Company | Website | Phone Number |

|---|---|---|---|

| AAMI | Suncorp Group | aami.com.au | 13 22 44 |

| Allianz | allianz.com.au | 13 10 00 | |

| Apia | Suncorp Group | apia.com.au | 13 50 50 |

| CGU | Insurance Australia Group | cgu.com.au | 13 24 81 |

| CIL | Suncorp Group | cilinsurance.com.au | 1800 112 481 |

| GIO | Suncorp Group | gio.com.au | 13 10 10 |

| QBE | qbe.com.au | 13 37 23 | |

| MHIA | mhia.com.au | 1800 676 700 | |

| NM Insurance | nminsurance.com.au | 1300 019 411 | |

| Suncorp | Suncorp Group | suncorp.com.au | 13 11 55 |

| WFI | Insurance Australia Group | wfi.com.au | 1300 934 934 |

| Youi | OUTsurance Holdings | youi.com.au | 1300 258 381 |

| Australian Caravan Insurance | NM Insurance Pty Ltd | austcaravaninsurance.com.au | 1300 748 767 |

| Club 4X4 | club4x4.com.au | Not provided |

State Based Insurance Providers

| Insurer | Parent Company | State | Website | Phone Number |

|---|---|---|---|---|

| NRMA | Insurance Australia Group | New South Wales | nrma.com.au | 13 21 32 |

| RAA | South Australia | raa.com.au | 08 8202 4567 | |

| RAC | Western Australia | rac.com.au | 13 17 03 | |

| RACQ | Queensland | racq.com.au | 13 19 05 | |

| RACT | Tasmania | ract.com.au | 13 27 22 | |

| RACV | Victoria | racv.com.au | 13 72 28 |

This comprehensive list represents the major caravan insurance providers operating in Australia[2][3]. Each offers distinct policy features, pricing structures, and customer service approaches, making comparison essential for finding the most suitable coverage for your specific needs.

Comparison Of Coverage And Benefits

When evaluating caravan insurance options, understanding the differences in coverage and benefits between providers is crucial. While specific policy details vary and should be verified through product disclosure statements, the following table provides a general comparison of key features across different types of caravan insurance:

Coverage Comparison by Policy Type

| Feature | Comprehensive | Third-Party Fire & Theft | Third-Party Property Only |

|---|---|---|---|

| Accidental Damage | YES | NO | NO |

| Collision | YES | NO | NO |

| Fire Damage | YES | YES | NO |

| Theft | YES | YES | NO |

| Flood/Storm Damage | YES | NO | NO |

| Malicious Damage | YES | NO | NO |

| Legal Liability | YES | YES | YES |

| Contents Coverage | YES (often limited) | NO | NO |

| Emergency Accommodation | YES | NO | NO |

| Towing Costs | YES | Varies | NO |

This comparison illustrates the substantial differences in protection offered by different policy types, with comprehensive insurance providing significantly broader coverage than the alternatives[1][4]. When selecting a policy type, caravan owners should carefully consider these differences in light of their specific circumstances, including caravan value, usage patterns, and risk tolerance.

Specialised Coverage Options

Beyond standard coverage, many insurers offer specialised options particularly relevant to certain caravan users:

- Off-Road Coverage: Essential for those venturing beyond sealed roads, this coverage ensures protection continues during off-road adventures[1].

- Annex Coverage: Covers attached annexes and awnings that extend your caravan’s living space.

- Contents Upgrades: Options to increase the standard contents coverage amount for those traveling with valuable items.

- Lay-Up Discounts: Reduced premiums during periods when your caravan is stored and not in use.

- Multi-Policy Discounts: Savings when insuring multiple products with the same provider[1].

These specialised options allow for customisation of coverage to match your specific caravan usage and requirements. When comparing providers, consider not just the availability of these options but also their implementation details and associated costs.

Infographic: Caravan Insurance Comparison By Policy Type

Strategies for Optimising Coverage and Cost

Securing optimal caravan insurance involves balancing comprehensive protection with affordable premiums. Several strategies can help achieve this balance while ensuring your coverage meets your specific needs.

Understand Your Usage Patterns

Your caravan usage significantly impacts which insurance features matter most. Consider:

- Touring Frequency: Frequent travelers may benefit more from comprehensive coverage with roadside assistance and emergency accommodation.

- Travel Destinations: Off-road adventurers need specific coverage for unsealed roads and remote locations[1].

- Storage Conditions: Secure storage may qualify for premium discounts or allow for lay-up coverage during non-use periods.

- Typical Contents: Traveling with valuable equipment may warrant increased contents coverage.

By aligning your insurance with your actual usage patterns, you can avoid paying for unnecessary features while ensuring critical protections are in place.

Strategic Excess Selection

The excess (deductible) you choose directly impacts your premium costs. Higher voluntary excesses typically reduce premium payments but increase your out-of-pocket costs when claiming. Consider:

- Setting a higher excess if you’re financially prepared to cover more costs in the event of a claim

- Maintaining a lower excess if you prefer predictability and minimal unexpected expenses

- Balancing the premium savings against your risk tolerance and financial situation

This approach allows for significant premium reductions while maintaining comprehensive coverage for major incidents.

Leverage Discounts And Bundling

Most insurers offer various discounts that can substantially reduce premium costs:

- Multi-Policy Discounts: Insuring your caravan with the same provider as your car or home insurance often yields significant savings[1].

- Security Discounts: Installing approved security devices like wheel clamps, coupling locks, or GPS trackers may qualify for reduced premiums.

- Club Memberships: Some insurers offer discounts to members of caravan or camping associations.

- Loyalty Discounts: Remaining with the same insurer may result in progressively increasing discounts.

- Age Discounts: Many insurers offer lower rates for older, more experienced caravanners.

Actively seeking out and applying all relevant discounts can significantly reduce your insurance costs without compromising coverage quality.

Regular Comparison And Review

The caravan insurance market is competitive and dynamic. Strategies to maintain optimal coverage include:

- Annual policy reviews to ensure your coverage still matches your needs

- Regular market comparisons before renewal to identify better options

- Requesting price matching from your current insurer when you find better offers

- Reviewing coverage after significant changes to your caravan or usage patterns

This proactive approach prevents coverage gaps while ensuring you’re not paying more than necessary for your insurance.

Example Scenarios And Insurance Solutions

Different caravan owners have varying insurance needs based on their specific circumstances. The following scenarios illustrate how insurance solutions can be tailored to different situations:

Scenario 1: The Grey Nomad Couple

Profile:

- Retired couple in their 60s

- New luxury caravan valued at $95,000

- Planning extensive Australia-wide travel including remote areas

- Carrying valuable equipment including laptops, cameras, and medical devices

Insurance Solution:

This scenario calls for comprehensive insurance with:

- Maximum legal liability coverage

- Increased contents coverage (at least $5,000)

- Off-road protection for remote travel[1]

- Emergency accommodation and towing coverage

- New for old replacement provision for their valuable caravan[4]

The higher premiums associated with this comprehensive coverage are justified by the significant investment in the caravan and equipment, along with the extensive and remote travel plans.

Scenario 2: Weekend Warriors

Profile:

- Working family using their caravan primarily during school holidays

- Mid-range caravan (5 years old) valued at $65,000

- Mainly stays at established caravan parks

- Limited off-road travel

Insurance Solution:

This usage pattern suggests a balanced approach:

- Comprehensive coverage with standard contents protection

- Standard liability coverage

- Potential for lay-up discount during extended non-use periods

- No need for specialised off-road coverage if staying on sealed roads

- Consideration of a higher excess to reduce premiums

This approach provides solid protection during the family’s periodic caravan use while managing costs appropriately given the limited frequency of travel.

Scenario 3: The Vintage Caravan Enthusiast

Profile:

- Owner of a 1970s vintage caravan valued at $12,000

- Restored and maintained as a hobby

- Occasional weekend use within 200km of home

- Stored securely when not in use

Insurance Solution:

This specialised case might benefit from:

- Third-Party Fire & Theft coverage if willing to self-insure for minor damage

- Agreed value policy specifying the restoration value rather than market value

- Security discounts for secure storage arrangements

- Consideration of limited-use policies if available

This approach acknowledges the lower replacement cost while still protecting against major risks like theft and liability claims.

Legal Considerations And Disclosure Requirements

Caravan insurance in Australia operates within a defined legal framework that includes specific disclosure requirements and obligations for both insurers and policyholders.

Product Disclosure Statements

All caravan insurers must provide a Product Disclosure Statement (PDS) that details the policy’s terms, conditions, exclusions, and limitations[5]. This document forms the legal basis of the insurance contract and should be carefully reviewed before purchasing coverage.

Key elements typically addressed in the PDS include:

- Precise definitions of covered events and exclusions

- Excess amounts and application conditions

- Claims processes and requirements

- Cooling-off periods (typically 14-21 days) during which you can cancel without penalty[5]

- Cancellation procedures and refund policies

Understanding these details is essential for making informed decisions and avoiding surprises when making claims.

Duty of Disclosure

Policyholders have a legal obligation to disclose all relevant information when applying for caravan insurance. This includes:

- Accurate caravan details including modifications and accessories

- Intended usage patterns, particularly off-road travel

- Security arrangements and storage locations

- Claims history and previous insurance refusals

Failure to properly disclose relevant information can result in claim denials or policy cancellations. It’s essential to be thorough and honest during the application process to ensure valid coverage.

Legal Compliance

Caravan insurance providers in Australia must comply with various regulatory requirements, including:

- Adherence to the General Insurance Code of Practice

- Operating under appropriate Australian Financial Services Licenses

- Meeting ASIC regulatory guidelines

- Providing mandated cooling off periods[5]

These legal frameworks provide essential consumer protections and set standards for insurance operations throughout Australia.

Conclusion

Caravan insurance represents an essential investment for Australian caravan owners, providing financial protection and peace of mind during travels throughout the country’s diverse landscapes. The wide range of available coverage options allows for customisation to match specific needs, usage patterns, and budgets.

When selecting caravan insurance, owners should carefully consider:

- The appropriate level of coverage based on caravan value and usage

- Specific features needed for their particular travel style

- Balance between premium costs and protection levels

- Opportunities for discounts and cost optimisation

- Provider reputation for claims handling and customer service

By thoroughly researching options, understanding policy details, and implementing the strategies outlined in this guide, caravan owners can secure optimal protection while managing costs effectively. Regular policy reviews and market comparisons ensure ongoing alignment with changing needs and market offerings.

The comprehensive provider list included in this guide serves as a starting point for detailed comparison shopping. Ultimately, the ideal caravan insurance policy balances comprehensive protection for your specific circumstances with reasonable cost and reliable service from a reputable provider.

Citations

[1] https://www.club4x4.com.au/caravan-insurance/

[2] https://www.caravan-insurance.com.au

[3] https://www.austcaravaninsurance.com.au/contact-us/

[4] https://everythingrv.com.au/blog/essential-guide-to-caravan-insurance-and-repairs-in-australia/

[5] https://www.austcaravaninsurance.com.au/wp-content/uploads/2023/03/Australian-Caravan-Insurance_Caravan_PDS_0423.pdf

[6] https://newwavemarine.com.au/caravan-insights/caravan-insurance-how-costly-is-caravan-insurance-in-australia/

[7] https://www.cilinsurance.com.au

[8] https://www.cilinsurance.com.au/rv-insurance/caravan-insurance.html

[9] https://www.qbe.com/au/caravan-insurance

[10] https://canterburycaravans.com.au/finding-the-best-caravan-insurance-in-australia/

[11] https://www.takalvans.com.au/blog/how-to-lower-caravan-insurance-premiums

[12] https://rvdaily.com.au/caravan-insurance-buyers-guide/

[13] https://financialservicesonline.com.au/articles.php?id=1461

[14] https://www.compareinsurance.com.au/caravan-insurance/guides/guide-to-caravan-insurance

[15] https://thegreynomads.activeboard.com/t61967353/caravan-insurance

[16] https://snowyrivercaravans.com.au/insurance-for-caravans/

[17] https://salutecaravans.com.au/caravan-insurance-101-guide/

[18] https://www.forbes.com/advisor/au/car-insurance/best-caravan-insurance/

[19] https://www.youi.com.au/you-connect/articles-and-guides/things-to-consider-before-buying-caravan-insurance

[20] https://www.australianunity.com.au/insurance/caravan-trailer-insurance

[21] https://www.nminsurance.com.au/our-brands/australian-caravan-insurance/

[22] https://www.finder.com.au/car-insurance/caravan-insurance

[23] https://www.allianz.com.au/leisure/caravan-and-trailer-insurance.html

[24] https://www.lewisrv.com.au/blog/caravan-insurance/

[25] https://www.cgu.com.au/documents/caravan/pds

[26] https://www.youi.com.au/caravan-and-trailer-insurance

[27] https://www.canstar.com.au/caravan-insurance-non-rated/

[28] https://www.apia.com.au/caravan-insurance.html

[29] https://www.nrma.com.au/caravan-insurance/caravan

[30] https://www.austcaravaninsurance.com.au

[31] https://thegreynomads.activeboard.com/t67886369/caravan-insurance/

[32] https://www.allbrandcs.com.au/7-must-know-caravan-insurance-mistakes-that-can-cost-you-a-fortune/

[33] https://www.strata.insuranceonline.com.au/articles.php?id=835

[34] https://www.nrma.com.au/content/dam/insurance-brands-aus/nrma/au/en/documents/caravan/nrma-caravan-pds-spds002-1023-nsw-act-qld-tas.pdf

[35] https://www.youi.com.au/you-connect/articles-and-guides/how-much-caravan-insurance-do-i-need

This article provides general information about caravan insurance in Australia and should not be considered financial or legal advice. Insurance products, features, benefits, exclusions, and pricing may change over time and vary between providers. The comparisons and information provided are based on research conducted as of April 2025 and may not reflect current market offerings. Before purchasing caravan insurance, readers should carefully review the Product Disclosure Statement (PDS) and other relevant documentation from specific insurers to understand the exact terms, conditions, and limitations that apply to their circumstances. Individual needs and situations vary, and what constitutes appropriate coverage differs between individuals. The authors and publishers of this article accept no responsibility for any loss or damage arising from reliance on the information contained herein. Readers should conduct their own research and consider seeking professional advice regarding their specific insurance needs.

List Of Australian Caravan Brands

Adventura Caravans, Adventure Caravans, Aliner Caravans, Alpha Fibreglass, AOR (Australian Off Road Caravans), Apollo Caravans, Aussie Wide Caravans, Australian Motor Homes Pty Ltd, Australian Off Road Caravans, Avan Campers, Avan Caravans, Avida RV, Bailey Caravans, Ballina Campervans, Beachmere Caravans, Big Red Caravan Co., Billabong Custom Caravans, Black Series Caravans, Broadwater Caravans, Bushtracker Caravans, Camprite Campers, Caravan Manufacturer, Caria Caravan Trailer, Challenge Camper Trailers Caravans, Chapman Caravans, Classic RTM Caravans, Concept Caravans, Coromal Caravans, Creative Caravans, Crusader Caravans, Customline Caravans, Davsher Caravans, Desert Edge Trailers, Designer Vans Caravans, Discoverer Campers, Dreamhaven Caravans, Dreamland Trailers, Driftaway Caravans, Dryden Trailers Caravans, Eagle Caravans, Elddis Caravans, Elross Caravans, Emerald Caravans, Evernew Caravans, Exodus Campers, Ezytrail Campers, Ezytrail Caravans, Galaxy Caravans, Goldstream Recreational Vehicles, Goldstream RV, Golf Caravans, Grand Tourer Caravans, Heaslip Campers, Horizon Motorhomes, I & D Industries, Imperial Caravans, Jayco, Jayco Caravans, Jurgens Australia, Jurgens Caravans, Kea Campers Australia Caravans, Kingdom Caravans, Knaus Caravans, La Vista Caravans, Lifestyle Leisure RV, Limit Seeker Camper Trailers Caravans, Lotus Caravans, Majestic Caravans, Mandurah Caravans, MARS Campers, MARS Caravans, May West Caravans, Melbourne RV, Metro Caravans, Millard Caravans, Montana Caravans, New Age Caravans, Nova Caravans, Olympic Caravans, Opalite Caravans, Outback Caravans, Paradise Caravans, Paradise Motor Homes, Paramount Caravans, Regal Caravans, Regent Caravans, Retreat Caravans, Rhinomax, Rivenlee Caravans, Roadstar Caravans, Roma Caravans, Royal Flair Caravans, Shasta Caravans, Snowy River Caravans, Spaceland Industries Caravans, Spinifex Caravans, Suncamper Caravans, Sunland Caravans, Sunliner Recreational Vehicles, Supreme Caravans, Swagman Aust Caravans, Toy Haulers Manufacturer, Track Trailer, Trackabout Caravan Co., Trailblazer Caravans, Trailblazers RV Caravans, Trailer Manufacturer, Trailstar Caravans, Trakka, Trakka Caravans, Trakmaster Caravans, Travelhome, Traveller Caravans, Truelux 5th Wheel, Universal Caravans, Vanguard Caravans, Victory Caravans, Western Caravans, Windsor Caravans, Winnebago Industries, Wirraway Motorhomes, Zone RV